With 2022 in the rearview mirror, 2023 will likely see the continuation and effects of the policies and shifts initiated last year to combat things like historic inflation and the aftermath of COVID-19 pandemic.

Furthermore, 2023 will likely be a relatively tumultuous year for issuers, investors and the capital markets in general due to economic uncertainties, the Fed’s aggressive take on interest rates and political shifts ahead. With the rapid rate of interest rate hikes, many fixed income investors are sitting on hefty unrealized capital losses in their portfolio. For both issuers and investors, it’s paramount to gauge the Fed’s stance on the U.S. economy and whether we will see a downward shift in the short-term interest rates stimulating municipal debt issuances and helping investors with their unrealized losses.

In this article, we will take a closer look at what CY2023 has in store for the capital market and the U.S. economy in general.

Be sure to check our Municipal Bonds Channel to stay up to date with the latest trends in municipal financing.

Gauging the Monetary Policy into 2023

With the Fed’s unprecedented rate hikes in 2022, in turn, altering the path of both fixed income and equity markets, we will see how the financial market responds to these changes into 2023. There have been continuous conversations about a hard or soft landing of the economy, post the rate hikes, and whether it will induce a recession. This financial picture paired with the Eastern European conflict & ongoing supply chain issues are shaping up to be a recipe for a global recession.

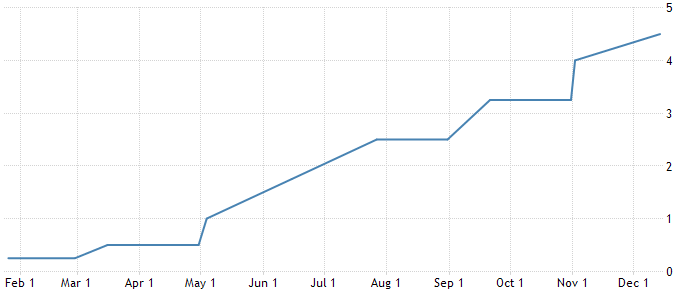

We are clear on where the Federal Reserve Chair, Jerome Powell, stands on the U.S. economy when he mentioned that we have tools to fix the broken economy, but not runaway inflation – indicating that rate hikes will likely continue until either inflation gets under control or an economic recession occurs. The chart below shows the pace of interest rate hikes in CY2022.

Source: Federal Reserve

In terms of the municipal debt markets, there has been a large influx of capital through federal and state governments through initiatives like American Rescue plan (ARPA), which has diminished the need for funding that could’ve been raised through issuing municipal debt. In addition, with the higher interest rates to raise capital, more governments are choosing to focus on capital projects that have some form of a funding plan tied – for example, capital projects funded through APRA federal funds. When looking at the accumulated issuances for CY2022, the markets registered a downward trend, which will likely continue into the new year unless of course the rates come down, fostering an environment for cost-effective capital issuance for local and state governments. Along the same lines, investors may also be skeptical with the recessionary talks, as they may jeopardize the underlying credit quality of their holdings and/or affect the revenue sources for local governments that could be pledged for future debt issuances.

For investors, until the rates come down, this could be a great opportunity to put their liquid capital to use and lock in very attractive returns for a longer duration. This could also be a way to generate additional premiums, as it’s a given that when the rates come down and the current investments are selling at much higher than their face value the inverse relationship between interest rates and bond prices rises.

Check out this article to see if it makes sense to buy closed-end municipal bond funds.

Reasons for Cautious Optimism

For investors and issuers, CY2023 may be a year to position ourselves to capitalize on the forecasted market trends, including the forecasted economic slowdown, downward pressure on interest rates and shift in the monetary policy to stimulate growth.

With the choppy 2022 behind us, many of the economic shifts are already in place that will likely result in the positive shift in the economies, whether it’s an intended slowdown of the economy to tame inflationary pressures or some other bellwether. Nuveen Investments, in its annual publication, also stated that “The course for municipal bonds in 2023 will likely depend on inflation levelling off or declining.” However, for investors who can look past the wider economic trends and focus on the fundamental strength of the municipal market, we believe taxable municipal bonds can be an important component in well-diversified, long-term portfolios. In terms of the credit strength, municipal credit fundamentals are particularly strong relative to corporate credit. Inflationary pressures are less impactful to municipal credit as higher costs can be pushed through to customers. Year-over-year revenues have increased in both 2021 and 2022 as inflation has bolstered municipal revenues while impacting the cost-side much less.

The Bottom Line

As we go into the new year, some challenges will continue: some will reshape into different challenges for the economies and some will cure with the policies & initiatives stated in the previous years. As investors and issuers navigate through the current times, it’s important to understand the importance of positioning for what’s in the forecast, which could entail keeping ample liquidity to capitalize on the near-term opportunities in the municipal debt markets. It’s also important to understand the revenues backing your municipal debt investments and how they can be impacted in a recessionary environment.

Sign up for our free newsletter to get the latest news on municipal bonds delivered to your inbox.