In the midst of current economic uncertainty, U.S. municipal governments are on track to issue over $60 billion in sustainable municipal debt in CY2022, reflecting a 30% increase from the 2021 numbers of $45.9 billion in sustainable municipal debt issuance.

In their recent report, S&P Global Rating indicates that municipal debt issued under the Environment, Social and Governance (ESG) label will continue to grow in the future, taking up a significant section of the overall municipal issuance. More and more local governments are tapping into the ‘Green Debt’ for their capital needs, which includes projects like water and wastewater utilities, financing green buildings, public transit, and much more.

In this article, we will take a closer look at the nature of sustainable debt and what the future holds.

Be sure to check our Municipal Bonds Channel to stay up to date with the latest trends in municipal financing.

Market Trends in the Green Borrowing

It’s important to understand what constitutes green debt or falls under the ESG label of municipal debt for local governments.

With an increasing focus on sustainability, both at the local and state level, social and governance factors are playing an important role in new debt issuances. It’s also important to understand this debt holds a special place in the hearts of many investors who are conscious of how local governments are making a difference in both their respective communities and the environment with their debt-funded capital projects.

Like an ordinary municipal debt issuance that enables local governments to raise capital to finance projects, including buildings, bridges, airports, and/or mass transit, ESG debt is also issued in a similar way. However, as Municipal Securities Rulemaking Board (MSRB) explains, “bonds that are characterized as “ESG” bonds finance infrastructure projects that have specific environmental and social benefits or implications in local communities. ESG-oriented municipal bonds may be of interest for investors who prioritize “impact investing” strategies or who integrate ESG policies into portfolio objectives, securities selection, or engagement with issuers. Credit rating agencies have integrated environmental, social and governance credit factors in their rating processes, and other market based ESG scores, and ratings have been developed to serve the rising information needs of investors and other market participants.”

As aforementioned, the ESG label includes the following factors:

- Environmental factor: This factor includes projects and issuers that have shown/proven the capability of withstanding or mitigating the effects related to climate change or effects of fires, storms, droughts etc., including transition to renewable sources of energy, preservation of the environment; some of these projects may fall under the construction of water and wastewater systems.

- Social factor: This factor may include helping/guiding the underserved communities by making services more accessible like access to education, healthcare, drinkable water, and affordable housing.

- Governance factor: This factor includes debt related to the overall planning and governance of local and state governments, which also includes long-term fiscal planning of operations.

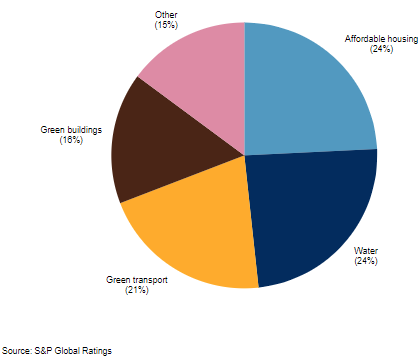

U.S. Sector Allocation Related to ESG Debt

One of the leading sectors for ESG issuances is affordable housing projects financed by local governments. These issuances fall under the Social governance of the ESG label and qualify to be issued under this municipal debt category. In recent data published through MSRB, the municipal debt issued for affordable housing increased by over $14 billion in 2021, including multiple state level agencies parking in the Environmental and Social Governance debt.

Some of these agencies include California Statewide Communities Development Authority (CSCDA), which issued over $4 billion ESG debt in 2021, and New York City Housing Development Corporation, which issued over $2.8 billion. Furthermore, investors saw a significant increase in Water, Wastewater, and Stormwater projects using sustainable debt to finance their capital projects. This area issued around $28 billion of ESG debt in 2021.

And, finally, transit agencies throughout the U.S. bore the brunt of COVID-19 shutdowns, due to the general public’s reluctance to travel using modes of public transportation. However, we witnessed mass transit agencies also issuing over $24 billion in sustainable debt.

Here is a glimpse of municipal sustainable debt issuances by sector from 2013-2021:

Potential Risks with ESG Debt

It’s important to note that ESG debt also carries some form of risk; some of the risk factors are also shared with other general municipal debt issuances.

- Investment rRisk: This is an over-encompassing general investment risk associated with all municipal debt investments. Every municipal debt investment comes with some form of credit risk and that often alludes to the municipal issuers’ ability to continue making the debt service payments, even during the time of financial collapse. There have been municipal issuers in the past that have not been able to meet their financial obligations and filed for bankruptcy.

- Taking advantage of the green label: Although not seen often, it’s not entirely impossible for an issuer to issue municipal debt with the ESG label, where the funding may not have gone to a project that falls under the Environmental and Social Governance label. It’s also called ‘greenwashing’ of the municipal debt that carries reputation and liquidity risk for the issuer as well as the investor.

- Details and data on the green project: The ESG debt, issued to finance projects related to the ESG strategy, will contain all required documents before and during the issuance; this will likely include the official statement, rating analysis, and all bond financing teams. However, post-issuance, investors may have a hard time obtaining detailed information about the project being financed.

Don’t forget to check our Muni Bond Screener.

The Bottom Line

I believe that a national fiscal health and conscious environmental strategy works in conjunction with building on the local government’s ability to continue with ESG strategies in their capital projects while also building on fiscal resiliency. The large increases in overall ESG issuances indicate not only the investor appetite for this type of municipal debt label, but also local government’s involvement in being conscious about their social and environmental footprint.

Investors should carefully review the official statement and rating analyses before making investments in any municipal debt issuances.

Sign up for our free newsletter to get the latest news on municipal bonds delivered to your inbox.

Disclaimer: The opinions and statements expressed in this article are for informational purposes only and are not intended to provide investment advice or guidance in any way and do not represent a solicitation to buy, sell or hold any of the securities mentioned. Opinions and statements expressed reflect only the view or judgement of the author(s) at the time of publication and are subject to change without notice. Information has been derived from sources deemed to be reliable, the reliability of which is not guaranteed. Readers are encouraged to obtain official statements and other disclosure documents on their own and/or to consult with their own investment professionals and advisers prior to making any investment decisions.